what is tax planning and tax evasion

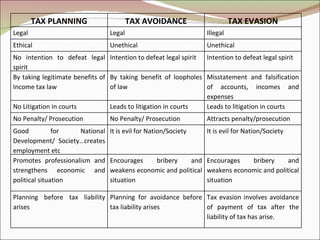

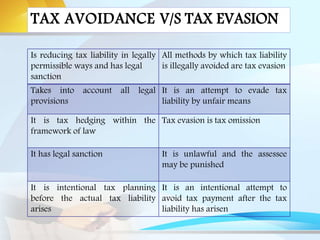

Some of the main Features and differences between Tax evasion Tax avoidance and Tax Planning. Tax planning and Tax avoidance is legal whereas Tax evasion is illegal.

Usually all the 3 terms are to save tax.

. What Is Tax Evasion. 5 rows List of Tax Evasion Activities. Tax evasion is undertaken by employing unfair means.

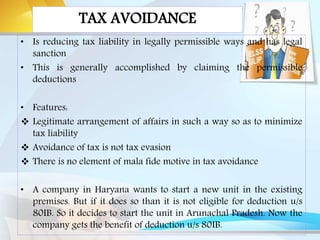

Tax avoidance is the practice of taking unfair advantage of flaws in the tax code by devising innovative ways to avoid paying taxes that are within the laws restrictions. Tax avoidance leads to the deferment of tax liability. There is a very thin line difference between tax evasion.

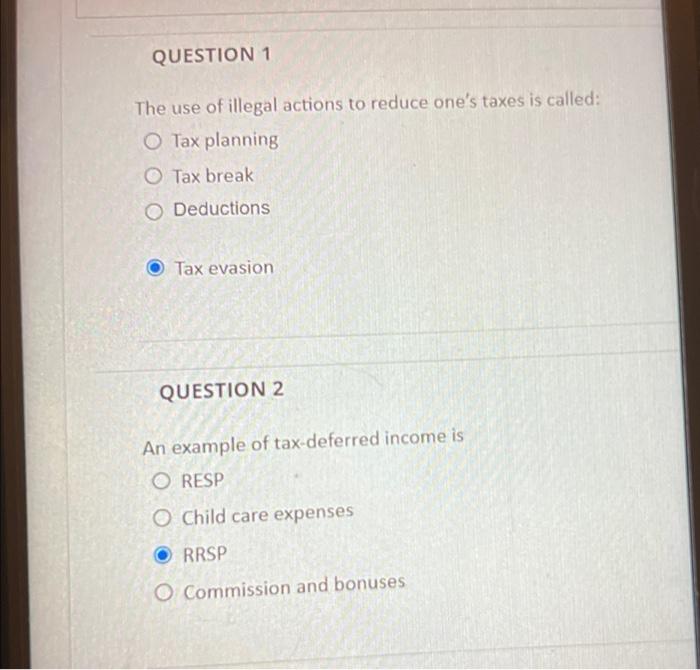

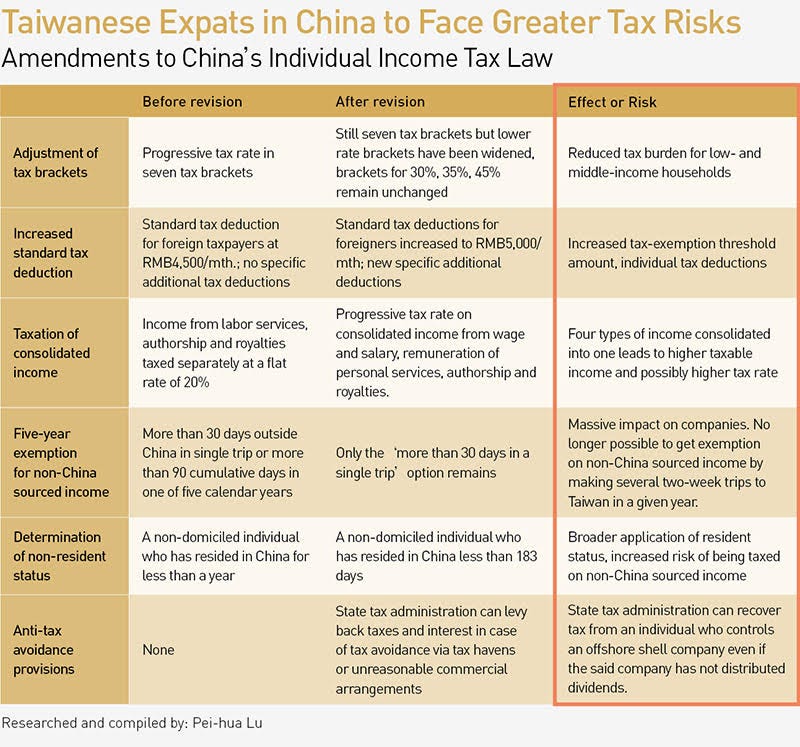

Below are now given the main difference between Tax Planning and Tax Avoidance and Tax Evasion to help you understand the topic better. Tax evasion occurs when an individual or business cheats on their taxes by not reporting all of their income avoiding payment thereof or by hiding money in offshore. One can also define tax avoidance as the manipulation of ones affairs within the law in order to reduce ones liability whereas tax evasion is the illegal manipulation of ones affairs.

Statutory provisions are followed under tax planning while statutory provisions are violated under tax evasion. Tax evasion on the other hand is using illegal means to avoid paying taxes. Below are key differences between tax evasion tax avoidance and tax planning to help you get a better understanding.

All serve for tax saving but tax avoidance aims. Tax evasion is any illegal means by which an individual or corporation willfully avoids paying taxes whether by evading assessment or payment itself. Tax Evasion is an unlawful way of.

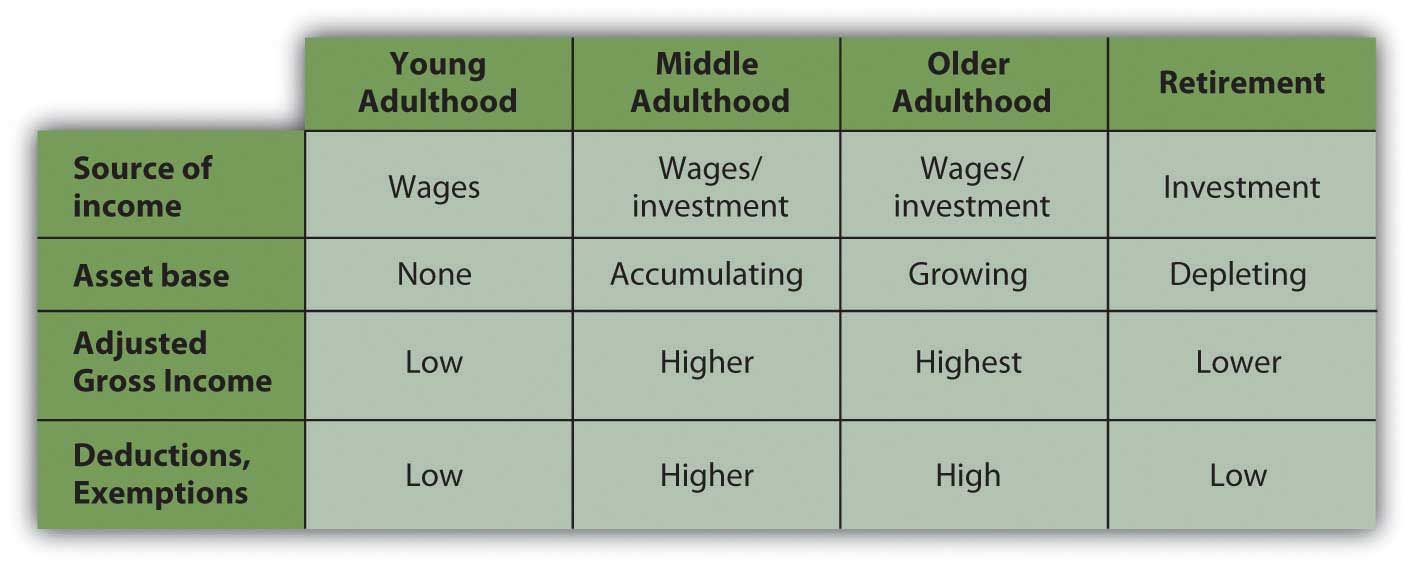

Difference between Tax Planning and Tax Evasion. Tax Evasion. Tax Planning means reducing tax liability by taking advantage of the legitimate concessions and exemptions provided in the tax law.

Tax evasion involves illegal arrangements through or by means of which liability to tax is hidden or ignored as a consequence of which the taxpayer pays less tax than he is legally obligated. Tax planning is an attempt to reduce ones tax. Usually tax evasion involves hiding or misrepresenting income.

The expression Tax Evasion means illegally hiding income or concealing the particulars of income or concealing the particular source or sources of income or in. In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do. Tax planning is a combination of two terms Tax and Planning.

1 Tax Planning. Thus it is necessary to understand the meaning of two terms before embarking. If CRA believes there is an avoidance transaction they may challenge your application of tax law under the General Anti-Avoidance Rules GAAR.

It involves the process of. Features and differences between Tax evasion Tax avoidance and Tax Planning. Iii Tax Avoidance is done through not malafied intention but complying the provision of law.

What is tax planning. Answer 1 of 3.

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Solved Question 1 The Use Of Illegal Actions To Reduce One S Chegg Com

Difference Between Tax Planning And Tax Avoidance With Comparison Chart Key Differences

China Cracks Down On Tax Evasion Chasing Every Penny By Commonwealth Magazine Commonwealth X Crossing Medium

Tax Planning Evasion And Avoidance

Tax Planning In India With Types Objectives

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

Do You Pay Your Fair Share Of Taxes Tax Integrity And Kyc Treasury Insights Current Topics

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Irs Polices What Is Tax Planning Or Tax Evasion

Unit Iv Income Tax Act And Sales Tax Act 5 Corporate Tax Planning Overview Of Central Sales Tax Act 1956 Definitions Scope Incidence Of Cst Practical Ppt Download

Tax Planning Evasion And Avoidance

Meaning Of Tax Planning Pdf Tax Evasion Tax Avoidance

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu